With an openness to foreign investment, Panama stands out as a destination where can foreigners buy property in Panama is not just possible, but facilitated through the same property ownership rules that apply to Panamanian natives. The appeal of real estate investment opportunities in Panama is buoyed by the security that approximately 90% of land beyond the capital city awaits titling, beckoning with potential for development in coastal and island regions1. A commitment to understand foreign property ownership rules in Panama unveils a world brimming with fiscal potential and lifestyle upgrades for the discerning investor.

While the judiciary’s independence is ranked lower, at 133 out of 1421, and the processes for registering property and enforcing contracts have room for improvement, with rankings of 1201 and 1191 respectively according to the World Bank, the nation remains steadfast in its drive to streamline foreign investment ingress.

Key Takeaways

- Ownership equality for Panamanian real estate regardless of buyer nationality.

- Affordable investment opportunities in untitled land outside Panama City.

- Transparency in the legalities of foreign property purchase.

- Implications of Panama’s judicial and property registration rankings1.

- The relevance of due diligence in international real estate transactions.

Exploring the Popularity of Panama for Foreign Real Estate Investors

Boasting a service-driven economy that makes up around 80% of the country’s gross domestic product2, Panama’s allure for foreign investment is unmistakable. This robust economic backdrop consistently entices expats and investors, positioning the Panama property market for expats as a powerhouse within the region. The legal requirements for foreign property buyers in Panama are accommodating, which is an additional magnet for global capital.

US Retiree Attraction to Panamanian Property

American retirees are discovering the unique appeal of Panama as a haven that offers a perfect blend of affordability, natural beauty, and community spirit, making it an ideal retirement destination. These expatriates benefit from Panama’s economic incentives and the comparably low cost of living without compromising on lifestyle quality

Economic Stability and Investor Incentives

Panama’s commitment to economic growth is evident not only through its significant role in international trade but also in its approach toward foreign direct investment. With FDI reaching around $1 billion through September 2007 with notable contributions in the banking sector and the Colon Free Zone2, investors are met with a country that is both welcoming and receptive. Add to this, major projects like the expansion of the Panama Canal2, financed by increased tolls and billions in debt financing, and the picture of a nation on an upward trajectory becomes crystal clear.

Geographical Appeal: Access to Both Oceans

Panama’s unique geographical location, bridging the Atlantic and Pacific oceans, is not only a strategic advantage but also a considerable draw for investors seeking the idyllic coastal lifestyle that the country offers. The prospect of investing in a country with titled property comprising only about 35%2 of the land suggests vast opportunities for growth and development in the real estate sector.

Embedded within its verdant landscape, Panama offers an array of incentives, like the ability for foreign companies to bid on canal contracts under the same terms as local firms2, enticing multinational corporations to the country. It’s no surprise that the legal requirements for foreign property buyers in Panama are designed to support this thriving environment, reinforcing the panama property market for expats as a top consideration for international investors looking for both prosperity and paradise.

Can Foreigners Buy Property in Panama?

The allure of buying property in Panama as a foreigner is strong, given the country’s strategic location and appealing lifestyle options. An important aspect to note is that approximately 90 percent of the land outside Panama City is untitled1, which can pose challenges for those unfamiliar with the real estate sector. Notably, Panama is ranked 120 out of 183 countries on the Registering Property measure1. To that end, The U.S. Embassy in Panama provides essential information on living in Panama that can help navigate these complexities.

Prospective owners should be aware of the position of Panama in global rankings regarding judicial processes. It ranks 133 out of 142 countries for judicial independence1, and similarly, is positioned at 119 regarding the Enforcing Contracts measure1. These statistics underscore the need for thorough due diligence and legal assistance when investing in Panamanian real estate as a non-citizen.

While the cost of legal services, such as notarial ones provided by the U.S. Embassy, is fixed at $100.00 ($50 for each signature of the Consular Officer)1, the cost of purchasing property in Panama can vary widely. Therefore, budgeting for all potential expenses, inclusive of legal fees, is critical for panama property ownership for expatriates. Additionally, understanding the local regulations, such as the issuance of disabled parking permits by the Secretaria Nacional de Discapacidad (SENADIS)1, is crucial for a smooth transition to Panamanian residency.

| Consideration Factor | Statistical Rank or Fact | Implication for Foreign Buyers |

|---|---|---|

| Land Untitled Outside Panama City | Approximately 90%1 | Necessitates careful land titling process |

| Judicial Independence | 133/142 countries1 | Legal diligence required for property disputes |

| Registering Property | 120/183 countries1 | Highlights need for knowledgeable legal help |

| Enforcing Contracts | 119/183 countries1 | Contractual agreements may need extra attention |

| Notarial Service Fee at U.S. Embassy | $100.001 | Relatively fixed cost for legal documentation |

| Disabled Parking Permit Issuance | Managed by SENADIS1 | Facilitates access for individuals with disabilities |

Overall, with careful planning and the right guidance, the dream of buying property in Panama as a foreigner can be a rewarding and fruitful investment for expatriates looking to enjoy the richness of Panamanian life.

The Advantages of Panama’s Real Estate Market for Non-Residents

Offering a robust growth trajectory and a welcoming business environment, Panama’s real estate sector stands out as a beacon for non-resident investors and homebuyers. The country’s GDP blossomed by 10.8% in 2022, showcasing a strong rebound from the previous year’s contraction3. This economic revival echoes through the various facets of Panama’s property market, underlining the potential for real estate investment opportunities Panama presents.

Legal Protections for Foreign Property Buyers

Understanding the foreign property ownership rules in Panama is crucial for anyone considering purchasing property as a non-resident in Panama. The legal framework in Panama is designed to protect the rights and investments of foreign buyers, ensuring parity with local investors. Dependable ratings from Moody’s (Baa2), Fitch (BBB-), and Standard & Poor’s (BBB) further reinforce confidence in Panama’s economic steadiness3. With a noteworthy 82% of the eligible population receiving at least one dose of COVID-19 vaccine3, Panama demonstrates its commitment to a secure and stable environment, which is a reassuring signal for investors.

Comparative Affordability of Panamanian Real Estate

Panama’s real estate remains competitively priced when juxtaposed with its international counterparts. This accessibility allows for entry into a market with ample opportunities, a factor keenly observed in sectors like commerce and transportation which grew by 16.3% and 13.7% respectively in 20223. Besides, an inflation rate variation of 2.9% and a relatively moderated debt-to-GDP ratio of around 58% in 2022 indicate a market that is both stable and conducive to potential growth3.

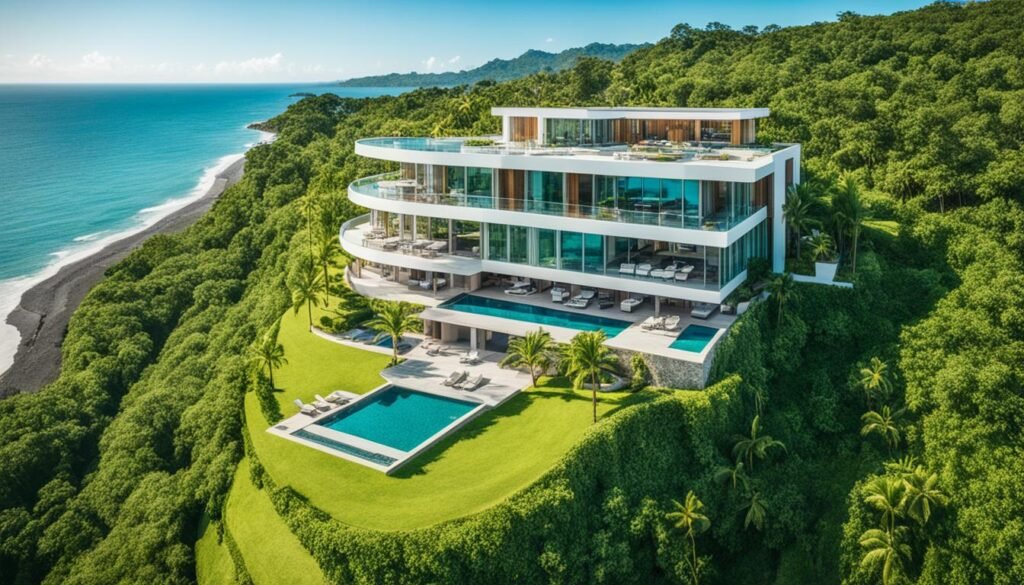

Diverse Property Types to Suit Any Preference

The flavor of Panama’s real estate portfolio is as diverse as its cultural tapestry. Whether one fancies a cosmopolitan lifestyle with luxury high-rise condos in Panama City or prefers serene beachfront vistas, the array of options caters to a wide spectrum of preferences. Indeed, the surge in economic activities in the arts, entertainment, and recreation sectors by a staggering 47.4% in 20223, along with hotels and restaurants climbing by 36.2%3, signals a vibrant market with diversified living experiences.

For detailed insights on the investment climate in Panama, real estate investment opportunities Panama are well-documented and illustrate why non-residents continue to find this Central American hub an attractive destination for property ownership.

Navigating the Legal Landscape: Purchasing Property as a Non-Resident in Panama

Understanding the legal intricacies is a critical step for those considering buying property in Panama as a foreigner. The allure of investment is bolstered by Panama’s vibrant economy and stable financial conditions, conducive to significant returns on investment. Moreover, the country’s strategic position as a global trade hub accentuates the value of real estate acquisition, furthering the appeal of the Investor Visa program4.

Understanding Fee Simple Ownership vs. Concession Rights

Panama’s property landscape accommodates various investment strategies, from the acquisition of luxury beachfront properties to urban condos, catering to the diverse preferences of investors4. Navigating property ownership types is paramount; fee simple ownership grants complete control of the property, whereas concession rights entail a leasehold framework, primarily used for properties within close proximity to national borders or on the shoreline.

The Public Registry and Legal Procedures in Acquiring Property

The Public Registry of Panama is a cornerstone of the property transaction process. It ensures accuracy and legality, providing peace of mind for the investor. The legal requisites for foreign property buyers in Panama are vigilant in safeguarding buyer interests, ensuring each transaction is sound and binding4.

| Key Advantage | Description |

|---|---|

| Investor-Friendly Tax Laws | No tax on foreign-earned income, with various incentives for lowered tax burdens4. |

| Strategic Global Trade Location | Access to international markets through the Panama Canal, benefiting Investor Visa holders4. |

| Real Estate Diversity | Options range from urban developments to serene highland retreats4. |

| Family Inclusion | Investor Visa benefits extend to spouses and dependent children, ensuring family security4. |

| Path to Permanent Residency | Temporary residents can transition to permanent residency after one year4. |

When meeting the legal requirements for foreign property buyers in Panama, prospective investors should also explore paths to securing residency. A fixed-term deposit in a Panamanian bank not only provides an opportunity to accrue interest but also serves as a conservative method to attain residency4.

In conclusion, with a meticulously structured legal system, tax advantages, and a variety of investment vehicles, Panama stands out as a hub for non-resident investors seeking to leverage the robust growth of its real estate market.

Panama’s Welcoming Approach to Expatriates and Retirees

The panama property market for expats is thriving, with ocean-view properties on both the Pacific and Atlantic coasts drawing in a global audience looking for both beauty and value5. Capitalizing on a stable currency environment with the U.S. dollar, Panama has secured its reputation as an attractive financial haven for international buyers5.

Residency through Real Estate Investment

Panama’s strategic location, serving as a global shipping and air travel hub, complements its vibrant real estate market by making it an accessible destination for property investors and expatriates alike5. With government policies and residency programs tailored to incentivize foreign investors, the process of integrating into Panamanian life is made more appealing5. The Panama Friendly Nations Visa, requiring property investments of at least $300,000, provides a pathway to residency and is reflective of Panama’s commitment to welcoming individuals from designated friendly countries into the fold of its society5.

Retiree Benefits and Tax Incentives

Retirees find a haven in Panama, not just for its lush urban developments and quality of life enhancements but also for the tangible fiscal benefits5. Property tax exemptions and the prospect of citizenship after five years of permanent residency demonstrate Panama’s efforts to attract retirees seeking both comfort and a sense of long-term security5. Property values, particularly in sought-after areas like Punta Pacifica and Costa del Este, continue to show a steady increase, presenting retirees with an investment that can appreciate over time5.

The commitment to infrastructure development, including transportation and urban renewal projects, further bolsters retirees’ confidence in committing to the Panama property market5. With no restrictions on foreigners purchasing property, Panama remains a beacon for expatriates and retirees who wish to own a slice of paradise without the red tape5.

As the Panama Canal’s expansion continues to drive economic growth, the demand for both residential and commercial properties is set to rise, making now an opportune time for expats and retirees to explore the benefits that this Central American gem has to offer5. Experiencing a unique blend of lush landscapes and urban convenience, Panama stands out as a highly desirable location for those seeking a serene yet connected retirement lifestyle.

For more insights into making Panama your home, whether as an investment or a retirement destination, explore the informative content provided on the vibrant Panama property market for expats.

Strategic Considerations for Investing in Panamanian Real Estate

Delving into real estate investment opportunities in Panama requires a robust understanding of the market’s dynamics and economic indicators which underscore the nation’s investment viability. With a remarkable GDP growth rate of 10.8% in 2022, following a steep contraction in 2020, Panama exhibits a resilience and upward trajectory that makes it an appealing landscape for investors3. The anticipated continued growth range between 5% and 6% for 2023 further cements the country’s strong economic footing3.

Attracting a substantial $3.5 billion in foreign direct investment from U.S. sources in 2021, Panama demonstrates its ability to charm major capital influx, which bodes well for the property sector3. Additionally, despite Moody’s Baa2 rating, Fitch’s BBB-, and S&P’s BBB with a negative outlook, Panama’s sovereign debt rating indicates an investment climate that remains robust amid challenges3.

Special Economic Zones and Investment Incentives

Special Economic Zones (SEZs) represent focal areas within Panama, designed to spur economic growth through investment incentives and tax benefits. Investors looking to maximize their involvement in the real estate markets are well-positioned to leverage these SEZs. They provide a structured and supportive environment for investment, aligning with the country’s laws that push for clean energy sources, like the ethanol blending mandates3.

Moreover, the initiation of duty-free access for U.S. consumer and industrial products since January 2021 invites additional commercial engagement in the region3. This, coupled with a high COVID-19 vaccination rate of 82% for single doses and 72% for two doses, suggests that Panama is establishing a foundation for sustained economic activities3. These factors position the country’s real estate market as a fertile ground for both residential and commercial developments within these zones.

Future Growth Potential for Property Values

The future growth potential for property values in Panama is underscored by several factors: a multi-levelled expansion of infrastructure, stringent investment in public projects like the Panama Canal, and a growing recognition as a logistics and commercial hub. Beyond the statistical encouragement provided by the $11.8 billion trade surplus with the United States in 2022, the Panamanian environment is primed for continued expansion in the property realm3.

Unemployment in Panama has seen a significant decrease from 18.5% in September 2020 to 9.9% in April 2022, mitigating some of the workforce concerns surrounding the property market3. Although approximately half of the workforce in Panama still operates within the informal sector as of April 2022, this may denote untapped sectors ripe for formalization and subsequent investment3. Balancing these elements with Panama’s current debt-to-GDP ratio at around 58%, it’s essential for investors to keep a close watch on debt levels while recognizing potential investment returns3.

Considering these strategic factors, it’s vital for investors to review the detailed investment climate statements for Panama to make well-informed decisions. With careful examination of the complex yet promising economic landscape, real estate investment opportunities in Panama, especially within its special economic zones and investment incentives, present an intriguing prospect for discerning global investors.

Financial Aspects of Purchasing Property in Panama

Understanding the financial intricacies is crucial for those exploring the foreign property ownership rules in Panama. Recognizing the costs, taxes, and funding options available can provide a clear roadmap for securing property investments in this vibrant market.

Bank Financing Options for Foreign Property Purchases

Panama’s banking sector offers attractive financing options for foreigners, making the acquisition of property a feasible venture. Many banks in Panama are experienced in handling international clientele, offering up to 70% financing on real estate purchases with competitive terms and rates. It’s important to note that the Panamanian government imposes a 2% property title transfer tax and a 3% advance of capital gains tax on the registered value, which typically the seller pays, although these costs can be negotiated6.

Using Retirement Accounts for Property Investments

For those looking towards retirement, Panama offers an appealing option where US citizens can utilize their IRA or 401K funds through specialized services to invest in property6. This unique opportunity aligns with the using retirement accounts for property investments strategy and aids in building a retirement portfolio that includes tangible assets in an emerging market.

| Financial Consideration | Average Cost |

|---|---|

| Typical Down Payment | 10% of Purchase Price6 |

| Closing Costs (Excluding Taxes) | 1-2% of Sale Value6 |

| Legal Fees | 1-2% of Transaction Value6 |

| Property Title Transfer Duration | 1 to 3 Weeks6 |

| Overall Purchase Process | 6 to 8 Weeks6 |

Steps to Secure Your Property in Panama

Exploring real estate investment opportunities in Panama presents lucrative prospects, yet it’s crucial to navigate the acquisition process with informed precision. The pathway to secure property in this vibrant region requires a structured approach, mindful consideration of legal nuances, and adherence to methodical steps to ensure a successful purchase.

The Importance of a Trusted Real Estate Agent

To streamline your property acquisition in Panama, engaging with a reputable real estate agent is a significant first step. A trusted local expert can provide invaluable guidance through Panama’s unique market landscape and assist in identifying properties that align with your investment goals. They serve as a critical intermediary, clarifying the complexities surrounding approximately 90 percent of untitled land outside Panama City and advising on the best course of action1.

Details on Closing Costs and Legal Fees

Understanding the financial details, such as closing costs and legal fees, is vital. Panama levies a property transfer tax of 2% on the sales value and a profit tax of 10% on the gain from property sales7. Sellers also shoulder an advance income tax equivalent to 3% of the sale value7, an expense often overlooked by buyers during budget planning. Furthermore, notarial services, such as those provided by the U.S. Embassy for driver’s license validation in Panama, incur fees—up to $1001.

Timeline for a Smooth Property Transaction in Panama

A well-managed property transaction in Panama typically spans 6-8 weeks, from the acceptance of the offer to the final title transfer. This timeframe accounts for necessary criminal record checks required by Panama, such as an FBI’s Identity History Summary Check1, as well as the Apostille service for international document use provided by the U.S. Department of State1. A firmly set timeline ensures all parties are aligned with the contractual obligations and commitments.

Thoroughly inspecting statutory obligations imposed on developers, such as a one-year guarantee on construction defects7, can prevent future disputes. It’s also essential to be prepared for potential delays and to understand the liability under old civil statutes that hold contractors responsible for damages within ten years of construction7.

| Tax/Fee | Amount/Details | Responsible Party |

|---|---|---|

| Property Transfer Tax | 2% of the sales value | Seller |

| Profit Tax | 10% of the gain from the sale | Seller |

| Advance Income Tax | 3% of the sale value | Seller |

| Notarial Services (U.S. Embassy) | $100 | Applicant |

| Annual Property Tax | Based on property value | Property Owner |

Positioned as a beacon for real estate acquisitions, the market in Panama complements its allure with tangible steps to secure your property in Panama. With the right guidance, investors can navigate the judicial rankings and property registration processes1, ultimately concluding with a rewarding investment in one of Central America’s most promising havens.

Conclusion

As we’ve detailed throughout this discussion, the question of whether can foreigners buy property in Panama receives a confident affirmative. The nation extends a heartfelt welcome to non-residents by offering the same property rights as for Panamanian citizens, which is a cornerstone of their foreign property ownership rules. Bolstered by an economic rebound where Panama’s GDP surged by 10.8% in 20223 and substantial US foreign direct investment, the future appears bright for both the country and potential investors3.

Panama’s inclusion to the list of countries with generous prospects for real estate investors is marked further by investment incentives like the U.S.-Panama Trade Promotion Agreement (TPA), initiation of which has broadened trade avenues since 20123. Additionally, the diverse real estate market growth, ranging from arts and entertainment to industrial manufacturing3, provides ample opportunity for personal use or investment purposes. With a substantial number of industries experiencing growth in 2022, including a significant 36.2% increase in the hotels and restaurants sector3, investors can look towards a robust market with confidence.

The path to property ownership in Panama is navigable with an understanding of the legalities involved. Upcoming legislation promising the possibility for foreigners to purchase island property8 demonstrates Panama’s efforts to maintain its competitive edge in attracting international interest. Finally, when considering the progressive economic indicators and a foreign property ownership framework designed to facilitate investment, Panama’s real estate market has firmly established itself as an advantageous venture for those looking abroad.

FAQ

Can foreigners buy real estate in Panama?

Yes, foreigners are allowed to buy and own real estate in Panama. The country offers the same property rights to foreigners as to Panamanian citizens.

Why is Panama popular among foreign real estate investors?

Panama is attractive to foreign investors for its economic stability, investor incentives, geographical appeal, and vibrant expat communities.

What are the advantages of Panama’s real estate market for non-residents?

Non-resident property buyers in Panama enjoy legal protections, comparatively affordable real estate prices, and a wide variety of property types to choose from.

What are the legal requirements for foreigners buying property in Panama?

Foreigners can buy property in Panama without restrictions. Understanding the difference between fee simple ownership and concession rights is important, and the Public Registry plays a role in the legal procedures.

What is Panama’s approach to expatriates and retirees?

Panama has a welcoming approach, offering various residency options, retiree benefits, and tax incentives to attract expatriates and retirees.

Are there strategic considerations for investing in Panamanian real estate?

Special Economic Zones and future growth potential are factors to consider when investing in Panamanian real estate.

Are there financing options for foreign property purchases in Panama?

Yes, banks in Panama provide loans for real estate purchases, and using retirement accounts for property investments is also an option.

How can I secure my property in Panama?

It is important to work with a trusted real estate agent, understand closing costs and legal fees, and expect a timeline of around 6-8 weeks for a smooth property transaction in Panama.

Source Links

- https://pa.usembassy.gov/living-in-panama/

- https://2009-2017.state.gov/e/eb/ifd/2008/100997.htm

- https://www.state.gov/reports/2023-investment-climate-statements/panama/

- https://www.choosepanama.com/blog/panamas-investor-visa

- https://thelatinvestor.com/blogs/news/panama-real-estate-foreigner

- https://www.relofirm.com/real_estate_faqs/

- https://www.lexology.com/library/detail.aspx?g=93951535-e446-4865-82ae-9f7580dce24b

- https://www.nytimes.com/2007/01/10/realestate/greathomes/10gh-home.html

Comments